Everything you need to know

We're on a mission to give people, businesses and their communities the financial boost they need, when they need it to bounce back from a quake. Questions about how our products work? Read on.

General Information

What is Bounce Earthquake Relief insurance?

Bounce Earthquake Relief insurance is a type of insurance that’s technically referred to as parametric insurance.

Parametric insurance is a policy that pays out a pre-agreed amount when a specified event occurs using a pre-defined index or parameter. For Bounce, this means our policy is activated by a significant earthquake that causes ground movement of at least 20 cm per second, as measured by Peak Ground Velocity (PGV) at your nearest GeoNet strong motion sensor.

It's important to note that parametric insurance is not designed to cover every type of loss. Instead, this policy focuses on less frequent but more severe earthquake events.

I'm a business owner, what should I consider when buying Bounce Earthquake Relief Insurance?

Things that you may want to think about when considering Bounce Earthquake Relief to support your business:

- Is your business exposed to earthquake risk?

- How much savings, working capital and balance sheet resiliency have you got in your business?

- Are there any gaps, excesses, deferments, or exclusions in your traditional policies?

- Do you have exposure to financial losses that may be unrelated to assets?

- Would your business benefit from a faster claims processing period?

What can I use the payment money for?

An attribute of a Bounce policy is that it provides cover for a broad range of losses that may not be covered by your traditional policies. As a result you may use the money for any quake related expenses or losses.

- For households and renters, the funds may be used to cover the excess payments on your other insurance policies alongside any additional uninsured personal and lifestyle costs resulting from an earthquake. This may include the need to undertake emergency repairs (e.g. security, weatherproofing, cleanup), childcare, elder care, pet care, compensate for loss of income, travel costs, accommodation costs, wellbeing support, replacing broken items, and the costs of technical and professional advice.

- For businesses, a parametric insurance policy offers strategic financial support in two key ways:

(1) as an Excess Deductible Buydown, providing financial relief from having to pay a high deductible at a time when you are likely to be financially vulnerable.

(2) as an Alternative Business Interruption cover, providing rapid claim settlement to support businesses exposed to business interruption but doesn't have BI, or needs faster access to cash following an event.

When cash flow is tight during a crisis, these funds can help stabilise your balance sheet and support a wide range of recovery needs. This includes property damage, lost revenue, and increased operating costs—such as supplier contract renegotiations, higher utility or service expenses, and reassigning staff to recovery tasks. You can also use the payout to manage indirect impacts, like supply chain disruptions, relocation costs, temporary office space, new equipment purchases, or employee wellbeing initiatives.

The only things not covered are losses already paid by other insurance, and losses due to bodily harm. Oh, and earthquakes caused by nuclear explosions, cyber attacks, wars and terrorist attacks. (Seriously.) Other than that, you're the one who will best know your needs—the payment is yours to spend as you need to recover.

Why does parametric earthquake insurance make good sense for New Zealand?

New Zealand has had 7 significant earthquakes in the past decade. The next Big One in New Zealand isn't a matter of "if" but "when".

Parametric earthquake insurance is beneficial for New Zealand businesses and households for several reasons:

- Quick Payouts: With confirmation of loss, parametric insurance provides rapid payouts based on predefined Seismic triggers. This means that after an earthquake, funds are quickly available to cover immediate expenses, helping individuals and businesses recover faster. This is important for households and businesses. The Financial Services Council Financial Resilience Survey (March 2020) found that 2 out of 5 New Zealanders said that they would not be able to access $5,000 if something unexpected happened to them.

- Simplicity and Transparency: The claims process is straightforward and transparent. There's no need for lengthy assessments or extensive documentation.

- Financial Resilience: Having quick access to funds helps maintain financial stability during the critical period following an earthquake. This can be crucial for both households and businesses to manage unexpected costs and continue operations.

- Complementary Coverage: Parametric insurance can complement traditional insurance policies. While traditional insurance covers significant losses, parametric insurance provides quick cash flow to address early phase recovery and miscellaneous expenses, ensuring a more comprehensive recovery strategy.

- Adaptability to Frequent Earthquakes: Given New Zealand's seismic activity, having a policy that responds swiftly to earthquakes is highly advantageous. It provides peace of mind knowing that financial support will be available in the early phase of a recovery cycle.

Overall, parametric earthquake insurance offers a practical and efficient solution for managing the financial impact of earthquakes in New Zealand.

What coverage options does Bounce offer?

Bounce offers 4 customer propositions:

- We offer coverage options for households and individuals with sum insured values of up to $20K available.

- We offer a slightly wider range of options for Small Business customers with sum insured values of $10K, $20K and $50K being available.

- We also provide larger business customers with a Commercial Policy option which allows them to buy coverage up to $2m. This option is available through your insurance broker.

- Finally, for larger organisations Bounce is able to provide coverage options in excess of $2m.

How is the premium determined?

Bounce's innovative coverage applies a premium based on the likelihood of an earthquake in your postcode. Powered by GeoNet/ GNS Science data, we have determined the likelihood of a major earthquake occurring at your insured address. Those sum insured locations with a higher earthquake risk will incur a higher premium charge.

Who issues the policy?

Bounce Insurance Limited is a Lloyd’s of London Coverholder and holds a Binding Authority agreement to provide earthquake insurance policies to New Zealand.

The good news for policy holders is that their policy is 100% underwritten at Lloyd’s of London (by the Lloyd's Syndicate 457).

Who is the Lloyd's of London?

Lloyd’s is the world’s leading insurance and reinsurance marketplace. Through the collective intelligence and risk-sharing expertise of the market’s underwriters and brokers, Lloyd’s helps to create a braver world.

The Lloyd’s market provides the leadership and insight to anticipate and understand risk, and the knowledge to develop relevant, new and innovative forms of insurance for customers globally.

It offers the efficiencies of shared resources and services in a marketplace that covers and shares risks from more than 200 territories, in any industry, at any scale.

And it promises a trusted, enduring partnership built on the confidence that Lloyd’s protects what matters most: helping people, businesses and communities to recover in times of need.

Lloyd’s began with a few courageous entrepreneurs in a coffee shop. Three centuries later, the Lloyd’s market continues that proud tradition, sharing risk in order to protect, build resilience and inspire courage everywhere.

For information on the financial strength ratings of Lloyd’s, please click here.

For more information on Lloyd’s, visit www.lloyds.com.

Why doesn't Bounce have a financial strength rating?

As a Coverholder for Lloyd’s of London, Bounce benefits from a partnership with Lloyds through Lloyd's Syndicate 457. Lloyd’s syndicates benefit from Lloyd’s brand and ratings, its network of global insurance licences, and its central fund, which is available at the discretion of the Council of Lloyd’s to meet any valid claim that cannot be met by the resources of the member. As all Lloyd’s policies are ultimately backed by this common security, a single market rating can be applied. For information on the financial strength ratings of Lloyd’s, please click here.

Is there a excess payment deducted from your claim payment?

There are no deductibles attached to your policy which means that you get to enjoy the full value of your policy entitlement. Each payment is deposited directly into your bank account.

Availability

Is Bounce available to renters?

Yes. Bounce provides accessible earthquake cover for renters. This is a proposition for a growing cohort of customers who have no access to traditional insurance cover in the event of an earthquake. This proposition is all about providing a cash payment to support customers with funding additional costs of longer-term temporary accommodation, rental renegotiations, damage, costs of accessing new flats, and responding to demand surge post crisis.

Is Bounce available to homeowners?

Yes. Bounce provides additional protection for risk aware homeowners. These customers are risk aware, appreciate the value of insurance, and are prepared to pay a little bit extra for additional cover. This supports customers by covering any excesses, it provides customers with cash to travel and leave the zone of secondary shaking, it covers additional life expenses that can do with pets, kids, and parents and everything else in-between, it provides a top up for temporary accommodation, and it can help respond to cost escalation when undertaking repairs and rebuilds.

Bounce will complement your existing insurance by boosting your financial resilience.

Is Bounce available to small and medium size businesses?

Yes, Bounce provides earthquake parametric insurance solutions for businesses. Any SME business or non-profit can obtain a policy for each location that it owns or operates . A business can apply for $10,000, $20,000, or $50,000 of coverage. The Bounce policy supports SME balance sheets in a crisis and helps cover the financial gaps resulting from the unexpected impacts of a earthquake. Bounce provides SME customers with:

- An affordable excess deductible buydown for those SME customers that incur a high excess under their Material Damage policy (e.g. an excess cost beyond their risk appetite).

- An alternative Business Interruption solution for businesses seeking additional protection (e.g. cash flow) in response to an earthquake event.

Is Bounce available to large businesses?

Yes, Bounce provides a commercial policy that provides up to $2m of parametric earthquake insurance for large property owners and business owners. A Bounce commercial policy allows businesses to transfer unwanted earthquake risk and ensure that they have access to cash to support and fast track their recovery. A business can apply for any coverage amount up to $2m. The Bounce policy supports balance sheets in a crisis and helps cover the financial gaps resulting from the unexpected impacts of a earthquake. Bounce provides commercial customers with:

- An affordable excess deductible buydown for those commercial customers that incur a high excess under their Material Damage policy (e.g. an excess cost beyond their risk appetite).

- An alternative Business Interruption solution for businesses seeking additional protection (e.g. cash flow) in response to an earthquake event.

Please engage your Insurance Broker for additional information.

Can I have multiple properties covered by Bounce?

Yes. You can apply for a Bounce policy for any location that you live in or own.

Can a married couple or roommates each have separate coverage even if they live at the same address?

Yes. However, a married couple or roommates who each have their own policy cannot both claim in respect of the same loss. This means that folks under the same roof just need to apply the funds to different recovery measures.

How old does a person have to be to qualify for Bounce's coverage option?

18 years or older.

Can Bounce be purchased in addition to other earthquake insurance policies?

Yes. Bounce can be purchased as additional coverage for someone who already has a traditional insurance policy. Note that a Bounce policy does not cover losses already covered by another policy, but it can be a valuable complement to conventional house and contents insurance because it pays quickly, has no deductible, and covers any extra expense, not just property damage.

Claims Payments

What is the trigger for a payment under the Bounce policy?

A Bounce policy is triggered by an earthquake as measured at your nearest GeoNet sensor, with a minimum Peak Ground Velocity (PGV) of 20cm per second, with a full payout made when the ground moves by 30cm per second (and subject to your confirmation via text or email that to the best of your belief that you have incurred a commensurate loss).

Putting this into commonly used terminology, this is equivalent to a high 5 or low 6 magnitude earthquake (pending depth, proximity and soil structure), and modelling indicates that these parametric trigger points are a good proxy for damage from an earthquake event. Bounce relies on your nearest GeoNet sensor to inform it when customers have been impacted by a large earthquake. Once notified of shake data from your Nearest GeoNet sensor, Bounce commits to settle your claim within days (e.g. 7 working days for residential and SME customers and 15 working days for commercial clients).

Why does Bounce use Peak Ground Velocity (PGV) rather than Magnitude?

Peak Ground Velocity (PGV) measures shaking intensity across impacted regions, as opposed to magnitude which measures the amount of energy released at the focal point of the earthquake. PGV is more accurate measure because it captures the increased shaking intensity across impacted regions. PGV data is also easily accessed from the GeoNet database in near real-time.

We chose a PGV threshold of shaking that's intense enough to cause disruption - enough to "mess life up" and create extra expenses - but still low enough that it's plausible.

The size of an earthquake can be measured in two ways - the amount of energy released (i.e. Magnitude) at the focus point of the quake, and the shaking caused by that energy release at different places around New Zealand (measured as an intensity metric such as Peak Ground Velocity).

- Magnitude is a measure of the amount of energy released by the earthquake and is a single fixed value for the event. It is a very localised (around the focus point of the quake) measure and does not take into consideration the intensity of shaking in surrounding regions.

- PGV is an intensity measure of ground movement at the epicenter of the quake in surrounding regions and describes the damage caused by ground shaking on buildings, infrastructure, and land damage.

How do you determine payment eligibility?

This is a cash flow solution with the objective of providing cover for financial losses and extra expenses resulting from an earthquake that meets the seismic trigger.

To ensure fast, fair payments, we use Peak Ground Velocity (PGV) intensity data from GeoNet. This data allows us to objectively identify areas where customers are highly likely to have extra costs as the result of a quake.

Payment eligibility is based on shaking intensity as reported from your nearest GeoNet sensor alongside completion of a loss declaration via text/email/webform. If your location is subject to shaking with a Peak Ground Velocity (PGV) of at least 20 centimetres per second due to the earthquake event and you complete the loss declaration, then you are eligible to receive payment.

To ensure responsive cover we apply a stepped payment. If shaking is equal to or greater than 20cm/sec but less than 25cm then we pay 10%, if the shaking is 25cm/sec but less than 30cm then we pay 40%, and if the shaking is 30cm/sec or greater then we pay 100% of sum insured amount.

In New Zealand, our PGV threshold of 20cm/sec corresponds to a high 5 Magnitude earthquake (pending depth and location of the shake), or a Modified Mercalli Intensity (MMI) of VII, and this is catagorised by GeoNet as a "Severe" earthquake. A severe earthquake is where people have difficulty standing, furniture moves, there is substantial damage to objects, and a few weak buildings are damaged.

How much will you pay me?

We recognise that earthquake events are complex systems and can result in a wide range of unexpected outcomes. We have applied a stepped-payout approach to helping you recover from an earthquake event based on the sum insured which is shown on your schedule. The amount that we will pay you following an earthquake will be calculated as follows:

| PGV range (cm/sec) | Payment (% of sum insured) |

|---|---|

| 20cm/sec to 25cm/sec | 10% |

| 25cm/sec to 30cm/sec | 40% |

| 30cm/sec+ | 100% |

We pay up to 10% of the sum insured amount if the PGV is equal to or greater than 20cm/sec

We pay up to 40% of the sum insured amount if the PGV is equal to or greater than 25cm/sec but less than 30cm/sec

We pay up to 100% of the sum insured amount if the PGV is equal to or greater than 30cm/sec

What's so special about 20cms/second?

Our risk modelling, alongside hindsight analysis of past events (i.e. looking at how Bounce would have applied to past events), suggests that a quake with a movement of 20cm per second is a good proxy for damage and is the point where there is likely to be some damage and extra expenses because of the quake.

How would Bounce have responded to past earthquake events?

Analysis by our actuaries of past earthquakes in New Zealand highlights that our policy would have responded and provided payouts in all the major earthquakes (e.g. earthquake magnitude of high M5 and above) experienced in New Zealand over the past decade.

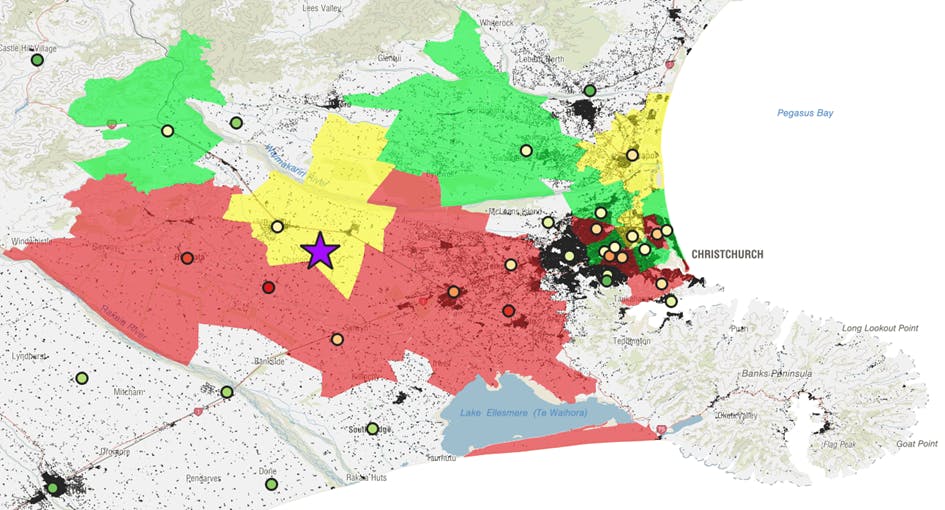

Darfield Earthquake, 4 September 2010: This quake occurred at a depth of 11km (shallow) with a magnitude of 7.2, a velocity (PGV) of 125.4cm/s (measured at the Greendale Sensor), and a MMI rating of X (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers if those customers were covered by a Bounce policy.

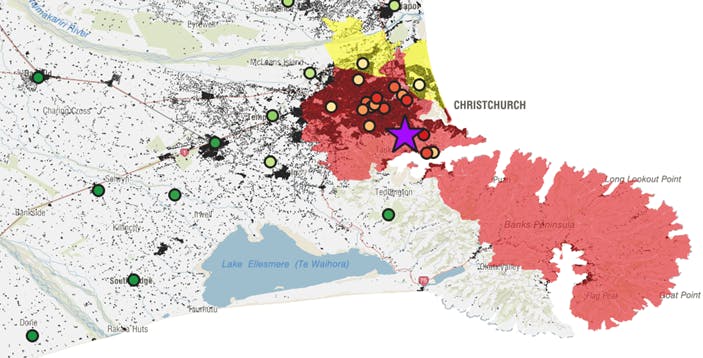

Lyttleton Earthquake, 22 February 2011: This quake occurred at a depth of 6km (shallow) with a magnitude of 6.2, a velocity (PGV) of 106.6cm/s (measured at Heathcote Valley Primary School), and MMI rating of VIII (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers if those customers were covered by a Bounce policy.

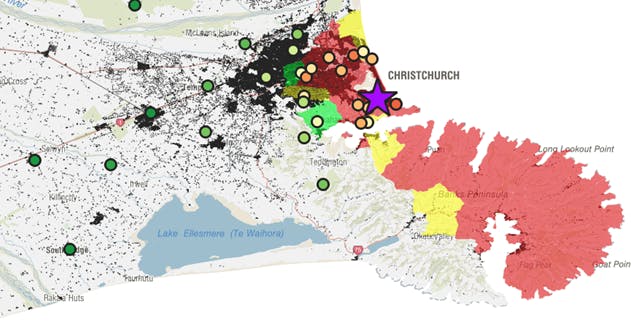

S.E Christchurch Earthquake, 13 June 2011: This quake occurred at a depth of 7km (shallow) with a magnitude of 6.0, a velocity (PGV) of 98.6cm/s (measured at Panorama Road sensor), and an MMI rating of VIII (Extreme). This caused further destruction of buildings, some displacement of land, and further disruption. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers if those customers were covered by a Bounce policy.

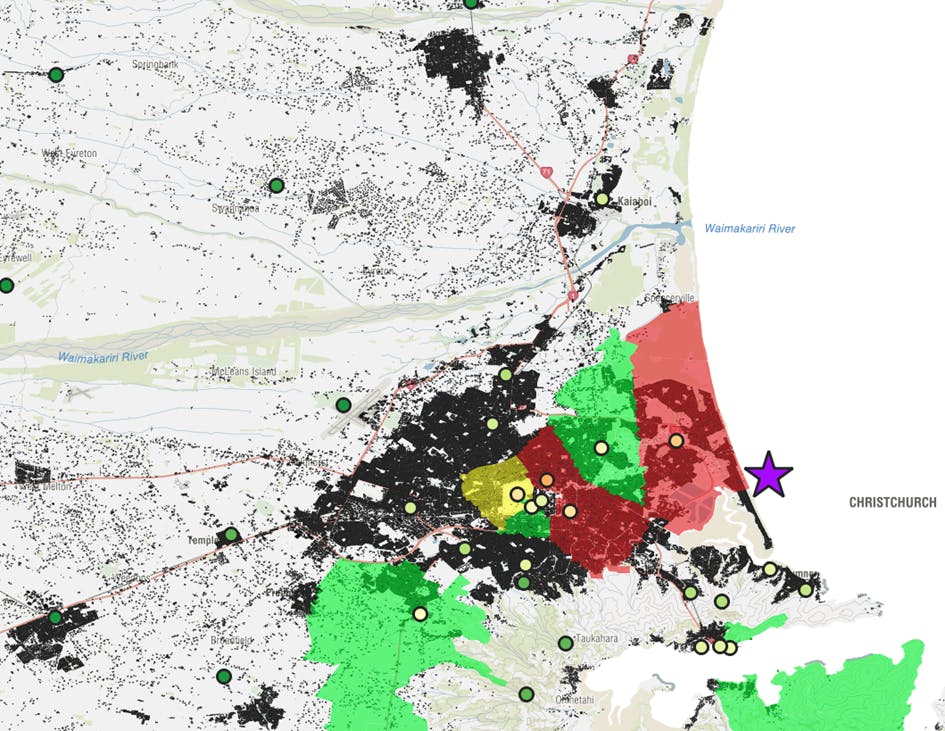

East Christchurch Earthquake, 23 December 2011: This quake occurred at a depth of 6km (shallow) with a magnitude of 5.8, a velocity (PGV) of 49.0cm/s (measured at the Resthaven sensor), and an MMI rating of VIII (Extreme). The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers if those customers were covered by a Bounce policy.

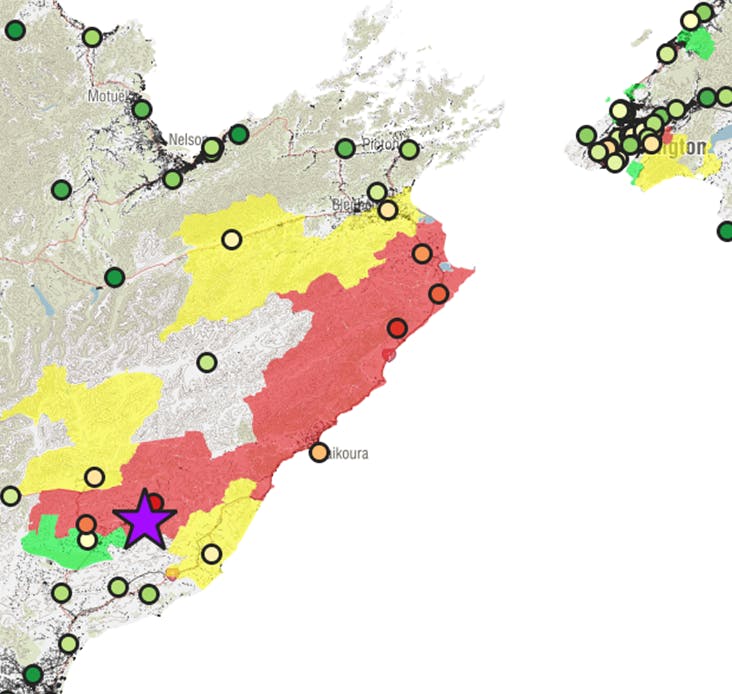

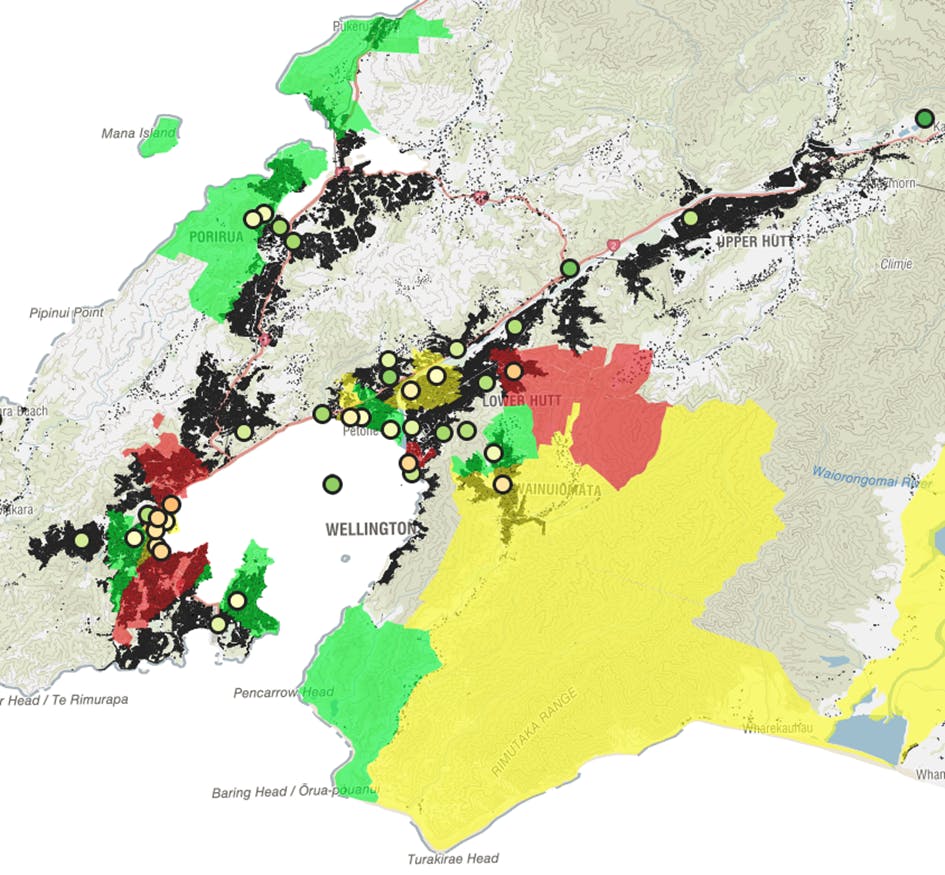

The Kaikoura Earthquake, 14 November 2016: This quake occurred at a depth of 15km (shallow) with a magnitude of 7.8, a velocity (PGV) of 116.8cm/s (measured at Waiau sensor), and an MMI rating of IX (Extreme). This caused widespread destruction of buildings, substantial displacement of land, and significant disruption through the Canterbury region, Marlborough region, and the Wellington region. The shading is red to indicate exceeding 30cm/s, yellow for 25cm/s and green for 20cm/s. Bounce would have supported many customers if those customers were covered by a Bounce policy.

The map below provides a more granular view of policy response in Wellington region as a result of the Kaikoura Earthquake.

How does the claims process work?

The claim management process is activated by a large earthquake when Bounce downloads earthquake data files from GNS Science which provides PGV shake data for each sensor. GeoNet sensor data is used to determine whether the ground shaking meets the trigger threshold for a claim payment.

After an earthquake occurs, if the highest PGV measured by Your Nearest GeoNet Sensor is at least 20cm per second, we send you a text message and/or an email that tells you that “You’re eligible to a claim payment”.

To receive a payment, you must complete the Loss Declaration procedure by responding to text messages initiated by us or by contacting us directly. To facilitate the Loss Declaration process, we will send you a text message to confirm that:

- You own, reside or work at the insured address (i.e. have a legal interest); and

- You have suffered a Covered Loss as a result of the earthquake event; and

- To the best of your knowledge and belief the Covered Loss will be at least equal to the amount that we pay you.

After you respond affirmatively, we initiate payment. We use text messaging because it's likely to be the first form of communication to start working after a disaster.

What happens if I am unsure of my loss?

In reality, you may not have a good sense of the impact of an earthquake within the first few days of the event. In this situation we encourage you to complete the Loss Declaration knowing that you may incur unexpected expenses along the way.

However, if you are unable to complete the Loss Declaration because you do not believe that your loss and extra expenses will be equal to or more than the amount that we will pay you then please contact Bounce by emailing us (support@bounceinsurance.co.nz) or calling us (0508 268623). We will arrange a partial payment of the amount that you expect to incur based on your knowledge and belief at the time. If your loss turns out to be more, then we will simply make additional payments up to the maximum of your entitlement.

Do I need to prove the value of my loss and/or expenses in order to receive payment?

No. When you are eligible for payment and respond affirmatively to our Loss Declaration process that to the best of your knowledge and belief you expect your loss and additional expenses to be at least the value of our payment to you, then we authorise the payment.

We do request that you keep any relevant receipts as evidence that funds were spent on your earthquake recovery as we do retain a discretion to carry out spot claims review under the residential and SME policy wordings.

For those with a Commercial Policy, we do require that you submit a written Proof of Loss after 210 pays of payment.

What if my losses and expenses turn out to be less than the amount that you pay me?

Earthquakes big enough to trigger payments will also be big enough to cause all sorts of unanticipated expenses, some of which won't become apparent until much later.

The policy (and the cover amount) has not been designed to insure people against all losses they may suffer due to an earthquake and our expectation is that the payment amount that we will pay you would be a fraction of what most people will need during the initial recovery.

However, if your expenses and losses are less than the amount that we have paid you then please contact us to discuss.

How does Bounce work with other policies I may have?

In the event of an earthquake, traditional house insurance is designed to cover significant losses, but Bounce offers something different. Our insurance product is designed to support your financial resilience by providing immediate cash flow for expenses resulting from an earthquake that aren’t covered by other insurance policies.

A Bounce cash payment is made within weeks, if not days, following an insured earthquake event, helping you manage any immediate financial losses or additional expenses as you begin your recovery journey. Bounce doesn’t replace or duplicate the coverage provided by other policies; instead, it complements traditional insurance by paying quickly, with no excess or deductible, and covering any extra expenses, not just property damage.

What if text messages don't work after the earthquake?

You can also provide your affirmative response by calling us (0508 268623); emailing us (support@bounceinsurance.co.nz); by logging into your account; or through Facebook messenger.

Insurance policies sold by Bounce are governed by the New Zealand Conduct of Financial Institutions regime ("CoFI"). Can you explain how this works?

As part of CoFI, Bounce (as a Lloyd’s Coverholder) is required to comply with the Fair Conduct Principle which applies to the activities within the Bounce business that relate to the following matters:

- Conduct risk and customer outcomes

- Product design and development

- Product distribution including consideration of target market and application of sales targets and incentives

- Company Code of Ethics and Values

- Approach to Vulnerable customers

- Whistleblowing

- Complaints.

Please click here to see a "Summary of our Fair Conduct Programme".

What is the Fair Insurance Code?

Lloyd’s is a member of the Insurance Council of New Zealand and its New Zealand Coverholders adhere to the Fair Insurance Code, which provides you with assurance that we have high standards of service for our customers. Bounce, being a Coverholder of Lloyd's, is committed to complying with the Fair Insurance Code as published by the Insurance Council of New Zealand.

This means we will:

- We're committed to high standards of service.

- We'll act transparently, and with integrity and utmost good faith towards you.

- We'll act in the interests of our customers by treating you honestly and fairly, and fulfilling our duties and obligations.

- We'll develop, market, and sell our products responsibly.

- We'll identify and address instances of poor conduct within our company.

- We'll communicate clearly and will.

- answer your questions accurately and in writing if requested.

- explain the information you need to give us when you apply for insurance, renew your policy, or make a claim.

- explain the importance of you disclosing information that is honest, complete, up-to-date and relevant.

- give you access to your policy wording, which sets out in plain English what is insured, what is not insured, and what your obligations are.

- tell you about changes to your policy.

- explain the decisions we make accurately, clearly, concisely and effectively in all our interactions with you.

- We'll train our staff and our agents so they can fulfil our responsibilities to you.

- You can access a copy of the code here.

What else should I know?

- Payment eligibility is based on Peak Ground Velocity measured by your Nearest GeoNet Sensor.

- Specifically, if your location is subject to shaking with a Peak Ground Velocity (PGV) of at least 20 centimetres per second due to the earthquake event, as determined on the basis of data from the Nearest GeoNet strong motion sensor, then you are eligible to file a claim.

- Data used to define payment eligibility are as reported by GeoNet usually within 24 hours after occurrence.

- You are entitled to claim for more than one Earthquake Event which may occur during the policy period, but the absolute maximum we will pay you for all earthquake events is the Sum Insured shown on your schedule.

- It's also useful to know that all earthquake events within a 168 hour period are treated as one Earthquake Event.

See full policy for detailed terms.

Our Team

What is the Bounce story?

Bounce was founded in 2020 by Paul Barton. Paul has a long career in insurance and was the Chief Risk Officer in his most recent role. Paul has spent many years working with claim teams and customers impacted by earthquake events in New Zealand.

Paul saw the financial hardship and stress that New Zealanders faced after the Canterbury Earthquake Series and after Kaikoura. This prompted Paul to think about a different way for insurance to be more responsive to the immediate financial needs of New Zealanders after an earthquake.

Bounce is based on the belief that quick recovery is key to mitigate financial hardship and minimise emotional stress for individuals and their families, and the wider community. From this belief Bounce was formed with a focus on promoting individual, business, and community recovery, by paying claims within days of an Earthquake Event.

Today we are a small team of highly committed specialists.

What is the Bounce mission?

At Bounce Insurance, our mission is to support communities by building financial resilience and providing rapid recovery insurance solutions after earthquake events.

We are committed to delivering innovative parametric insurance products that offer rapid financial assistance, empowering individuals, households, and businesses to rebuild and thrive in the aftermath of natural disasters.

What's your purpose?

Our purpose at Bounce Insurance is to provide innovative parametric solutions that ensure swift and effective recovery for every household and business in New Zealand.

We are dedicated to fostering resilience and financial stability, enabling our communities to bounce back stronger after earthquake events.

Support

Can I view a sample of the Residential / SME Bounce policy? A copy of the Commercial Policy is available on request.

See full policy for detailed terms.

Where can I get proof of coverage?

We email your electronic policy when you sign up and again each year. In addition, it's available in your account status. Simply log in. From there, you can print out a PDF if you need a paper copy.

Can I change insured person, location, credit card, email and mobile phone information on existing coverage?

Do I need to renew my policy every year?

Unless you tell us otherwise, your policy will renew with no action required from you. We will send you an annual reminder that your policy will renew.

How do I cancel coverage?

You can cancel at any time with no penalty. Simply call us at 0508 268623, click on the Chat box at the bottom right corner of this page, or send us an email at support@bounceinsurance.co.nz. We will cancel your policy that day and issue a pro-rated refund.

I have a question. How can I reach you?

Click on the Chat box at the bottom right corner of this page, or email us at support@bounceinsurance.co.nz and we'll respond quickly within business hours.

How secure is my information?

We use the strongest browser encryption available, and store all of our data on servers in a secure facility.

We protect the privacy of your information and will never share your data with any third party without your permission. For more information, please review our privacy policy.

You can't anticipate what you might need, it is reassuring to know I have a policy that settles claims quickly.